Dine-In Ordering feature for our Consumer Mobile App.

Louis Ramirez • May 14, 2020

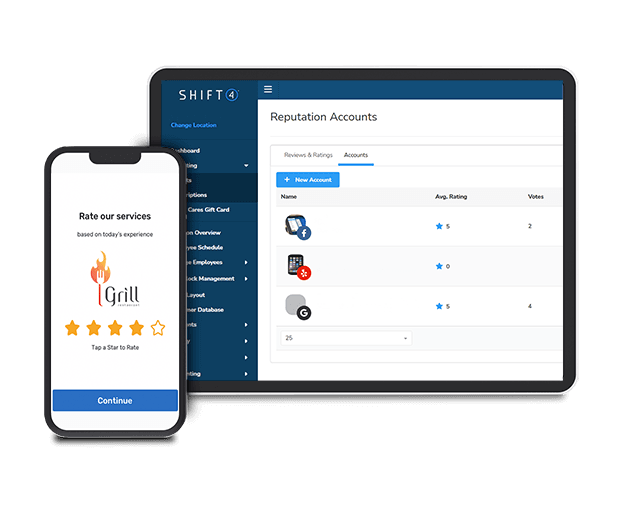

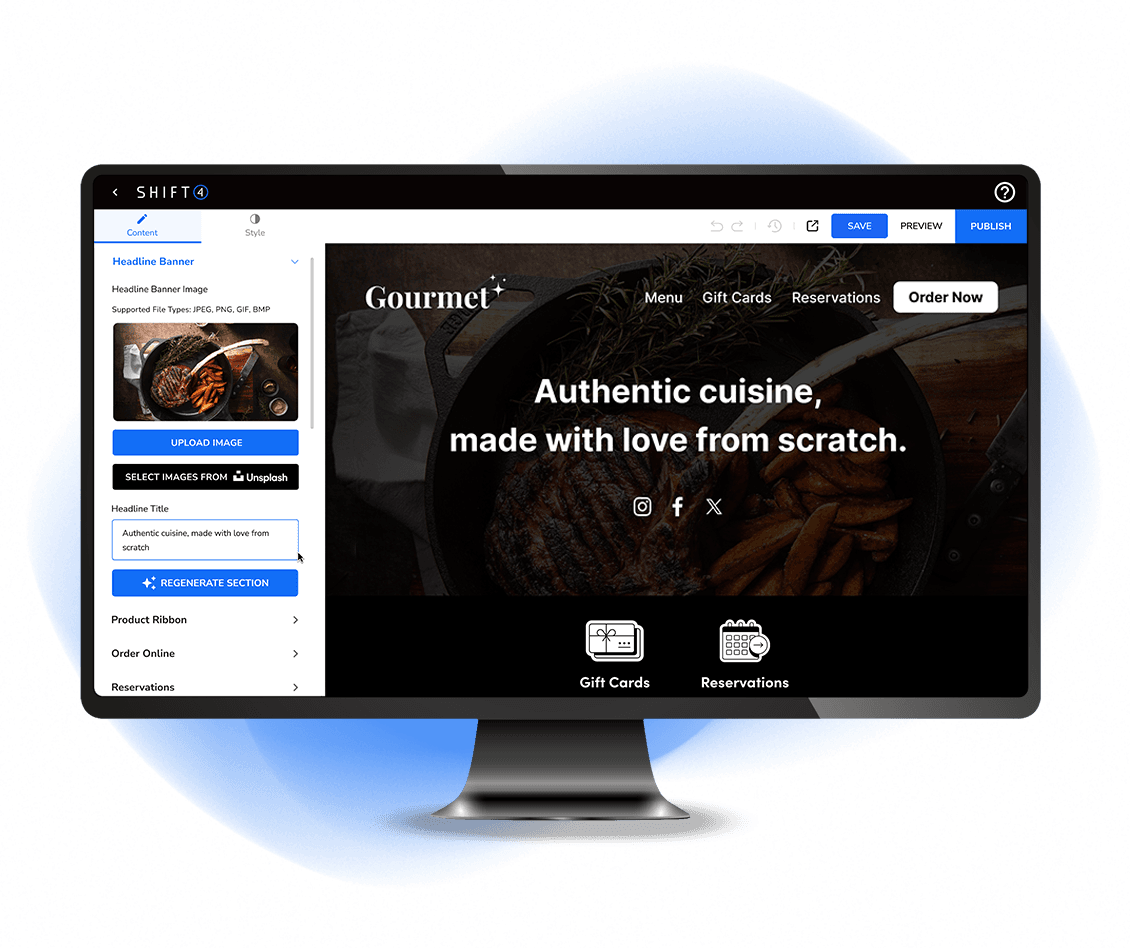

You asked for it and we listened! The groundbreaking feature will allow customers to go to a restaurant, enter their table number, and then order and pay at the table, without ever having to touch a menu or a credit card.

Restaurant operators are still trying to figure out how to adapt their business models to address coronavirus concerns, even as many states begin lifting restrictions, and this is the game-changing technology they need to both go contactless and promote social distancing while dining-in. It’s not just a temporary solution, either.

Book with Me

While many restaurants have experimented with table kiosks, the hardware is expensive and does nothing to stop the spreading of germs. In contrast to table kiosks, our Dine-In solution requires no extra hardware beyond their POS system, and is 100% contactless. We fully expect this to be a huge part of the long-term future for restaurants, as consumers flock to the conveniences of contactless payments and restaurants see first-hand the substantial cost savings in hardware and labor. Due to the urgency and need for this product, we will launch during Beta, meaning you will be able to get clients set up with this new feature ASAP.

Be on the lookout for more details coming soon!

Insights

Introducing the Smart Fee Calculator for Credit Card Processing

Are you tired of guessing the fees associated with processing credit card transactions? Look no further! Our **Smart Fee Calculator for Credit Card Processing** is here to make your life easier. This handy tool allows you to quickly and accurately calculate the cost of processing any dollar amount, taking into account both percentage-based fees and fixed transaction fees.

Simply enter the purchase amount, the percentage fee rate, and the fixed fee per transaction, and our calculator will do the rest. Whether you're a business owner looking to understand your transaction costs or a savvy consumer wanting to know how much extra you're paying, this calculator is designed to provide clear and instant results.

Say goodbye to complicated fee structures and hello to transparency with our Smart Fee Calculator. Try it out today and take control of your credit card processing costs!