Tax Tip Calculator

Tax Tip for Restaurant Owners

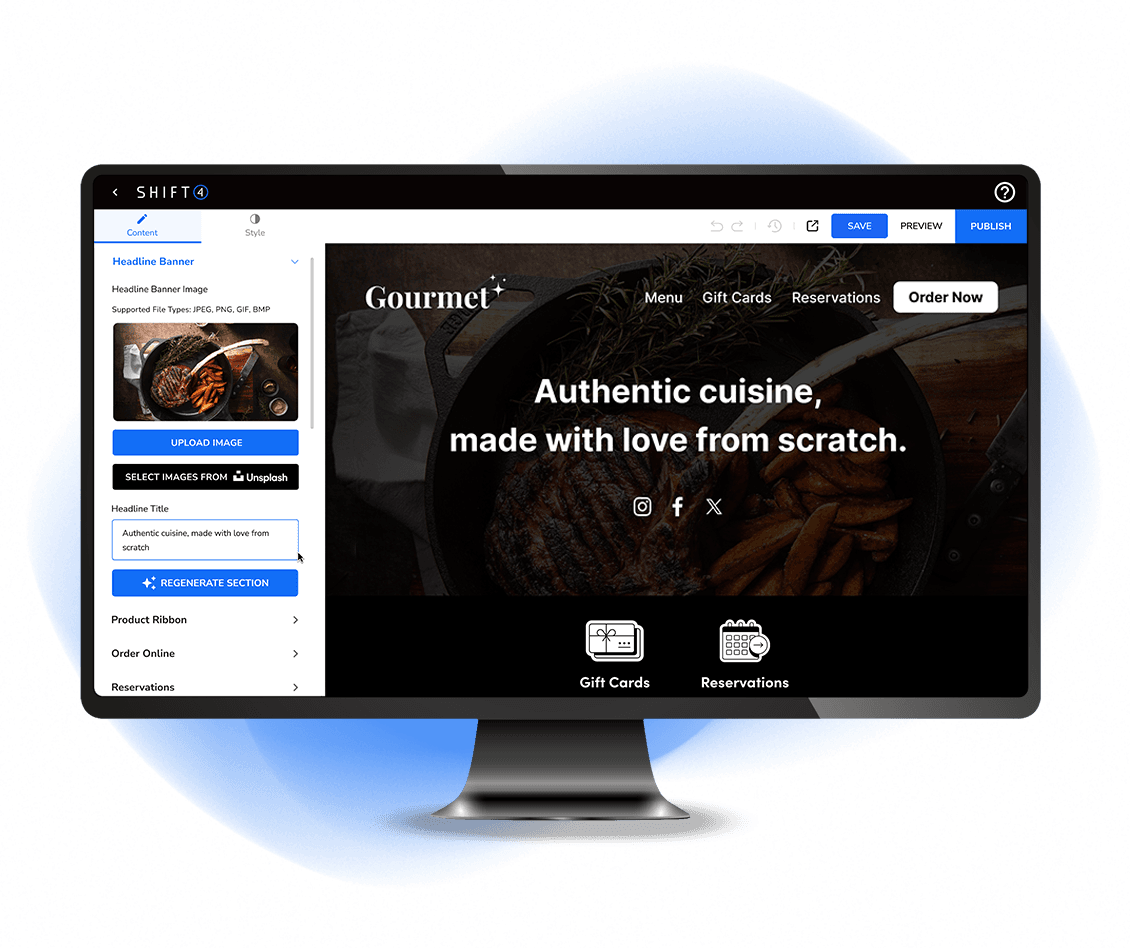

It's common knowledge that as a restaurant owner, you juggle multiple roles. From purchasing ingredients, marketing, training and hiring staff, to ensuring the quality of food and drinks, the tasks are endless. Amidst all this, finding time to manage the financial aspects of the business can be challenging.

Certain payroll considerations unique to restaurants, such as tips, meals, and service charges, require careful attention. According to the Federal Insurance Contribution Act (FICA), restaurants are obligated to pay taxes on the tips earned by their employees, as they are considered income. The FICA Tip Tax Credit presents a substantial tax-saving opportunity for restaurants, potentially saving them significant amounts. Both owners and employees have specific responsibilities in this regard:

- Daily accurate recording of tips

- Ensuring employees receive at least the state minimum wage for hours worked

- Submitting the Tax Credit request using Form 8846

To determine potential savings, visit the following link:

Insights