Per Visa "Surcharge is not the same as a Cash Discount"

Visa Compliance: Credit Card Cost Clarified

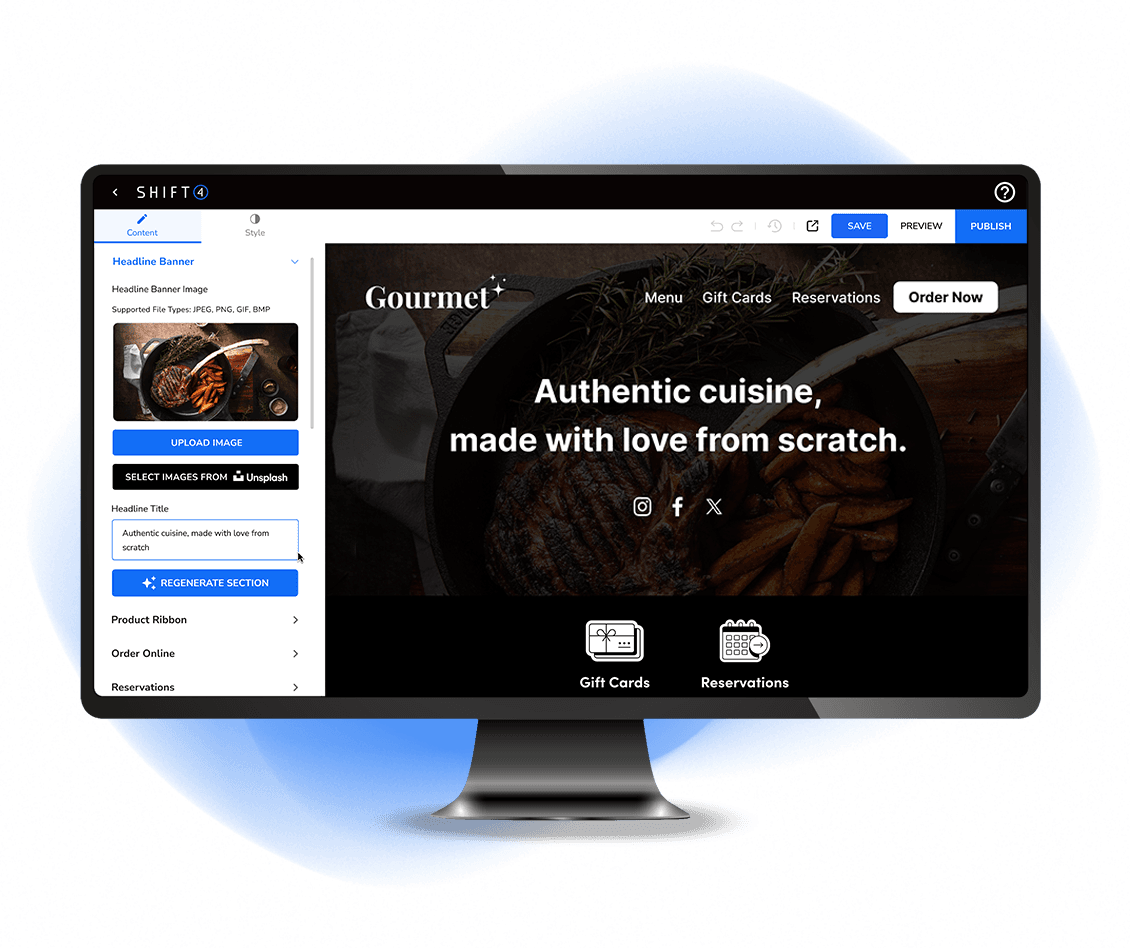

Restaurants: Ensure Compliance with SkyTab POS

Attention restaurant owners! Learn about cash discounts, innovative payment strategies, differences with surcharges, and compliant programs like Advantage. Discover a true cash discount solution and dual pricing aligned with Visa's guidelines.

Cash Discounts vs. Surcharges:

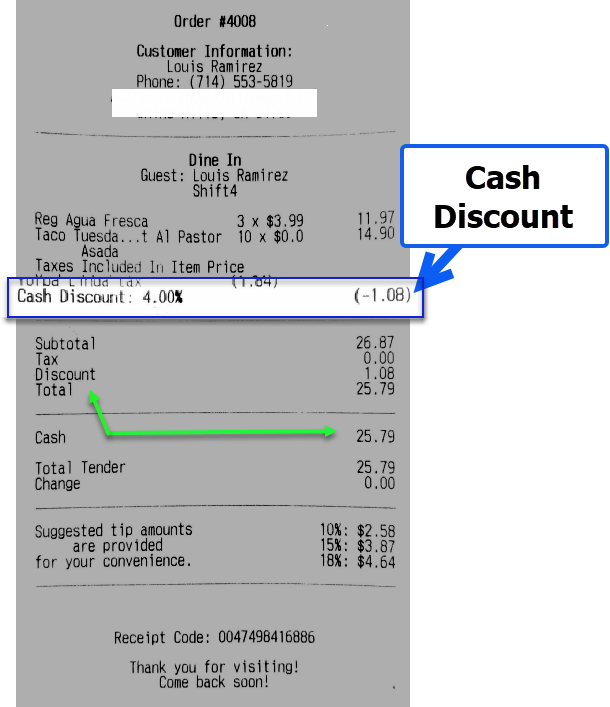

Let's make it clear: there's a difference between cash discounts and surcharges. Visa's rules explicitly permit merchants to provide discounts or rewards to customers who opt to pay with a method other than their Visa card. This "discount offer," also known as a cash discount, allows you to motivate customers to consider payment alternatives beyond credit cards. It's a win-win: customers save money, and you reap benefits as well.

By including the card price in your menu, the final bill shows the total price to be paid on the card, based on the total of the items being purchased as displayed by your establishment, allowing you to comply with Visa's surcharge regulations and provide clarity to your customers.

Compliant Dual Pricing Program:

In order to comply with Visa's surcharge regulations, it's essential to accurately present prices. The Advantage program offers a fully compliant cash discount solution that allows you to display the appropriate discount for paying with cash by showing only the card price per item on your menu.

Dual Pricing necessitates your business to exhibit prices by featuring both the card and cash prices next to each other per item on your Menu. This transparency fosters trust among your customers and improves their payment experience.

Furthermore, the dual pricing model poses an additional challenge for your business, as it requires you to list two prices on your menu, adding another layer of compliance.

Why Complying is Urgent:

Adhering to compliance requirements is not just a legal necessity, but also a strategic move critical for the success of your restaurant. By integrating compliant cash discount programs such as the Advantage program or embracing the dual pricing model, you showcase your dedication to fairness, transparency, and customer satisfaction. Neglecting Visa's surcharge rules could result in unnecessary complications and potential repercussions.

Utilizing cash discounts presents enticing opportunities for your restaurant to deliver value to customers and enhance payment processing efficiency. By grasping the distinction between cash discounts and surcharges, and integrating compliant programs like the Advantage program or adopting the dual pricing model, you position your business for success. Embrace the advantage of compliant cash discounts, cultivate customer trust, and unlock new possibilities for your restaurant's expansion. Take action now, comply, and enjoy the benefits!

Visa explanation of Cash Discount vs. Surcharge

Visa What is the difference between a "cash discount" and a surcharge? • Visa’s rules allow a merchant to offer a discount or incentive to a cardholder to pay with an alternative method other than their Visa card known as a “discount offer” or commonly a “Cash discount”. However, in order to do so correctly, the merchant must display their prices in either of these ways: § Only the card price per item § Both the card and the cash price listed side-by-side per item Moreover, when the cardholder is presented with their final bill for payment, the total price to be paid on a card be displayed in full based on the total of the items being purchased as displayed by the merchant and not achieved by applying an additional fee for a card payment as it may appear to be, and may be treated as, a surcharge and subject to Visa’s surcharge rules

State of California explanation of Surcharge and Cash Discount

In 1985, California passed a law (Civil Code section 1748.1) that prohibited merchants from adding a surcharge (an extra fee) when customers pay by credit card instead of cash. That law does allow merchants to give customers discounts for paying by cash, check, or debit card, as long as that discount is offered to all customers. The law was challenged by several businesses, and in January of 2018 a federal court held that the law could not be enforced as to the businesses which brought that case. (Italian Colors v. Becerra (9th Cir. 2018) 878 F.3d 1165.) The Attorney General will generally apply the Italian Colors decision to merchants that are similarly situated to the Italian Colors plaintiffs.w Paragraph

A consumer can submit a complaint against a business which has a questionable or non-compliant surcharge program which only charges "Credit Cards, and not Debit Cards"

Insights