Stay Compliant: Don't be caught! Avoid Fines with Proper Surcharge Practices

Compliance Alert: Avoid Penalties, Protect Your Business

Attention, restaurant owners! It's crucial to stay informed about the latest updates in the world of surcharge programs to protect your business from potential violations and hefty fines. Starting April 15th, 2023, Visa has intensified its efforts to ensure compliance with surcharge regulations, leading to increased visits to business owners for inspection. This blog post aims to raise awareness among restaurant owners, providing essential information to help you steer clear of violations and avoid financial penalties.

The consequences of non-compliance with surcharge regulations can be severe. Failing to adhere to the rules set forth by payment card networks like Visa can result in significant fines. Each violation can cost up to $1,000, which can quickly add up if multiple violations occur. As a responsible business owner, it's essential to understand the compliance requirements and take necessary measures to protect your establishment.

It's crucial to note that while surcharging is permitted for credit card transactions, debit card surcharging is strictly prohibited. This means that your restaurant cannot impose surcharges on customers using debit cards. Violating this rule can lead to compliance issues and potential penalties. It's important to educate your staff about these distinctions to ensure proper payment processing practices.

Alarming statistics reveal that over 80% of businesses are currently operating non-compliant surcharge programs. Many restaurants unknowingly engage in practices that can lead to violations, exposing themselves to unnecessary risks. Understanding the common pitfalls of non-compliance will help you avoid falling into the same trap.

To mitigate the risks associated with surcharging, many restaurants have adopted compliant payment programs such as Dual Pricing. Instead of imposing a surcharge, Dual Pricing offers customers two distinct pricing options: one for cash payments and a separate one for credit card payments. By implementing this approach, you provide transparency and choice to your customers while remaining compliant with payment network regulations.

Awareness is the first step towards ensuring compliance and protecting your restaurant from costly fines. By staying informed about the latest surcharge regulations and exploring alternative payment options such as Dual Pricing, you can confidently navigate the world of payment processing without fear of violations. Remember, compliance is not only a legal obligation but also a way to maintain customer trust and enhance your business's reputation. Stay tuned for further guidance and tips to optimize your payment practices and safeguard your restaurant's financial well-being.

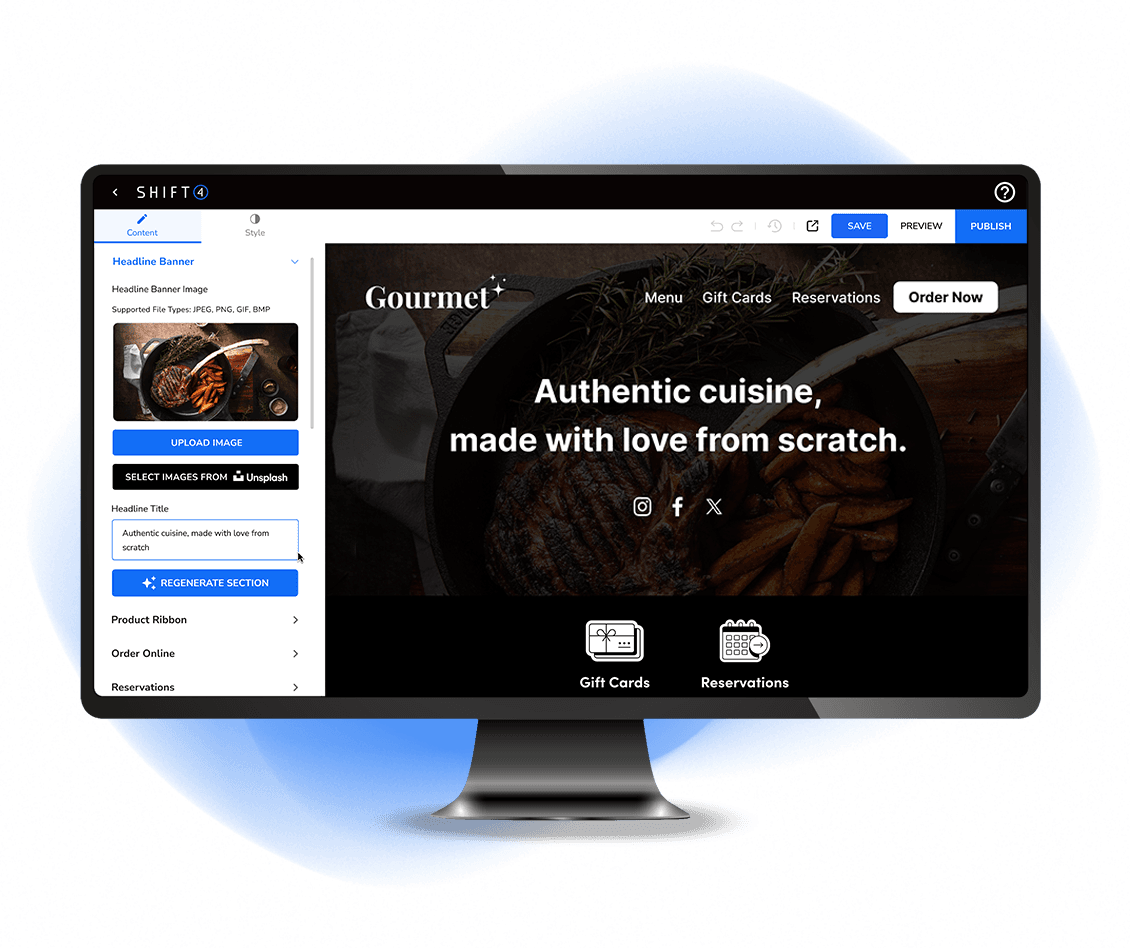

Ensuring Visa Regulation Compliance with SkyTab's Cash Discount Program

Is your Business Surcharging correctly?

Compliance with Visa’s requirements does not imply compliance with any relevant State laws

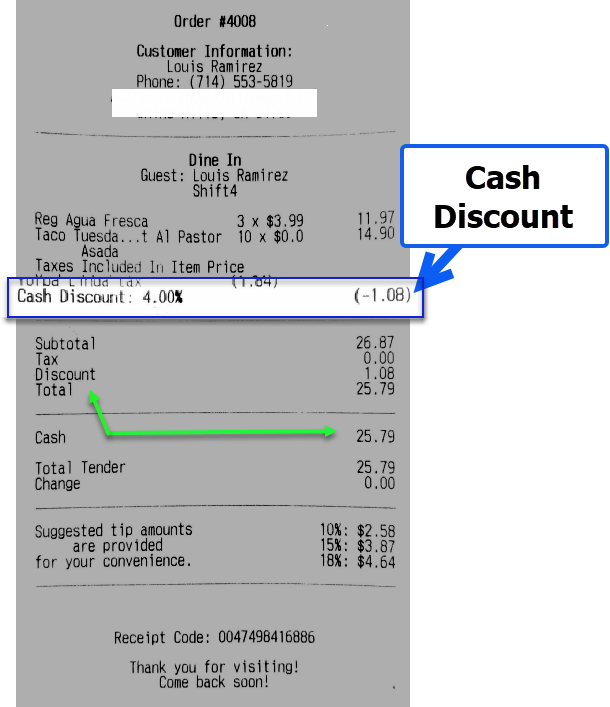

What is the difference between a "cash discount" and a surcharge?

Visa’s rules allow a merchant to offer a discount or incentive to a cardholder to pay with an alternative method other than their Visa card known as a “discount offer” or commonly a “Cash discount”.

However, in order to do so correctly, the merchant must display their prices in either of these ways:

§ Only the card price per item § Both the card and the cash price listed side-by-side per item

Moreover, when the cardholder is presented with their final bill for payment, the total price to be paid on a card be displayed in full based on the total of the items being purchased as displayed by the merchant and not achieved by applying an additional fee for a card payment as it may appear to be, and may be treated as, a surcharge and subject to Visa’s surcharge rules

Insights